Understanding Range Trading

The range trading strategy is a well-established approach that traders use when the price of an asset consistently fluctuates between defined support and resistance levels. In this market condition, prices move sideways within a specific range, lacking a clear trend. This creates opportunities for traders to profit from predictable price movements in non-trending markets.

Traders engaging in range trading focus on assets that demonstrate well-defined price channels. By entering trades at established support and resistance levels, they aim to capitalize on price rebounds, generating profits from the oscillating movements within the range. This strategy can be applied across various financial instruments, including stocks, forex, commodities, and even cryptocurrencies.

Introduction to Range Trading Strategy

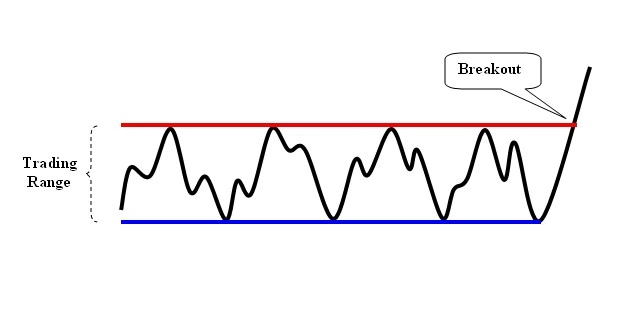

A trading range is established when an asset’s price moves between specific high and low points, typically identified as support (the lower boundary) and resistance (the upper boundary). When an asset exhibits this range-bound behavior, it signifies a lack of direction in the market, indicating that the price is not trending significantly upward or downward.

Range trading is predominantly a short-term strategy, making it particularly appealing to day traders, swing traders, and scalpers. Traders utilizing this approach seek to identify assets that exhibit clear ranges, hoping to profit from the price’s tendency to remain within these boundaries.

Key Principles of Range Trading

Buying at Support and Selling at Resistance

Range traders typically buy near the support level, anticipating that the price will rebound toward the resistance level. Conversely, they may sell or short the asset when it reaches the resistance level, expecting the price to decline back to the support level. This dual approach allows traders to exploit both upward and downward price movements effectively.

Establishing a Trading Range

Successful range trading requires accurately identifying support and resistance levels. A trading range can be validated when the price has tested these levels multiple times, indicating their reliability. The more times the price touches these established points, the more confidence traders can have in the range’s integrity.

Entry and Exit Strategies

The support and resistance levels serve as critical entry and exit points for trades. Traders must analyze price movements and determine the most likely direction the asset will take. For long positions, traders should look to buy at the support level and sell at the resistance level. For short positions, the opposite applies.

Utilizing Limit Orders

After establishing support and resistance levels, traders can use limit orders to automate their trade entries. Limit orders allow traders to set specific price levels at which they wish to buy or sell, minimizing the need for constant market monitoring and increasing the likelihood of entering trades at desired prices.

Monitoring for Breakouts

It’s essential to understand that trading ranges are not permanent; prices will eventually break through the established support or resistance levels. Traders should monitor their positions closely for potential breakouts, which can signal a shift in market sentiment. Employing risk management tools like stop-loss orders can help protect against adverse price movements. Traders may also choose to exit positions manually or use breakout strategies to capitalize on new price trends.

Analyzing the Range Trading Strategy

Technical Analysis

At the core of the range trading strategy lies technical analysis, which relies on historical price data to identify trading ranges. Traders can analyze any time frame, from minutes to days or even months, to establish support and resistance levels.

A straightforward approach to range trading involves identifying these levels on a price chart. This method is particularly accessible for beginners or those seeking to experiment with new market analysis techniques. Utilizing historical data can help traders understand how prices have behaved in the past, which is invaluable when predicting future movements.

Enhancing Analysis with Indicators

Beyond basic support and resistance analysis, traders often employ additional technical indicators to filter trades and identify optimal entry and exit points. Tools such as the Relative Strength Index (RSI) and Stochastic Oscillator are popular among range traders.

These oscillators provide insight into price momentum and indicate whether an asset is overbought or oversold. The RSI ranges from 0 to 100, with values below 30 signaling that an asset is oversold and values above 70 indicating it is overbought. Similarly, the Stochastic Oscillator signals overbought conditions when above 80 and oversold conditions when below 20.

Traders can use these indicators to confirm their decisions and refine their strategies. For instance, if an asset is approaching the support level and the RSI indicates that the asset is oversold, it may provide additional confidence to enter a long position.

Implementing Risk Management

Risk management is crucial in range trading, given the assumption that prices will remain within established support and resistance levels. A common tool for managing risk is the stop-loss order, which automatically closes trades when the asset price hits a predefined level. In range trading, stop-loss orders are often set just beyond the support or resistance lines, depending on the trader’s risk tolerance.

Setting stop-loss orders appropriately is essential. For example, if a trader buys near the support level, a stop-loss can be placed a few pips below that level to allow for minor fluctuations in price without triggering an exit. Conversely, if the price moves above resistance after a breakout, it could signal a shift in trend, prompting traders to close their long positions or place stop-loss orders on their shorts.

Advantages of Range Trading

The range trading strategy offers several advantages, particularly in non-trending market conditions:

Profit Potential in Sideways Markets

Many trading strategies are based on bullish or bearish trends. However, range trading provides a mechanism for traders to profit in sideways or non-trending markets, making it a valuable strategy to master. This allows traders to take advantage of stable price action rather than being forced to predict directional moves.

Applicability Across Asset Classes

Range trading can be applied to a wide array of assets, including shares, indices, ETFs, commodities, and forex. Regardless of the market, there are typically opportunities for profit during periods of price stagnation. This versatility makes range trading a useful addition to any trader’s repertoire.

Simplicity and Accessibility

The range trading strategy is relatively straightforward, making it suitable for both novice and experienced traders. While traders must still determine precise entry and exit points, support and resistance levels serve as useful guidelines. This simplicity allows beginners to grasp the fundamentals quickly.

Flexibility

Range trading allows for the possibility of short selling as well as going long, providing traders with multiple avenues for profit. This flexibility enhances the strategy’s appeal, allowing traders to take advantage of various market conditions.

Disadvantages of Range Trading

Despite its benefits, range trading does have drawbacks:

Breakout Risks

A significant risk associated with the range trading strategy is the potential for breakouts. When the price moves beyond established support or resistance levels, it can lead to losses if traders are not adequately prepared. Traders should remain vigilant and have a plan in place for these scenarios.

Limited Profit Potential

Range trading generally limits profit potential because it assumes prices will remain within a defined range. Larger price movements, and thus larger profits, are more likely in highly volatile markets with clear upward or downward trends. Traders may need to adjust their expectations accordingly.

Getting Started with Range Trading

To begin implementing the range trading strategy, follow these steps:

Open an Online Trading Account

Start by selecting a regulated broker and funding your online trading account. This will provide you access to a secure trading platform where you can manage your trades. Make sure to choose a broker with a good reputation and favorable trading conditions.

Access Trading Assets and Historical Data

Most trading platforms, such as MetaTrader 5 (MT5), offer a variety of assets and historical price charts. Use these resources to analyze past price movements and identify potential trading opportunities. Familiarize yourself with the platform’s features and tools to enhance your trading experience.

Identify Support and Resistance Levels

On your price chart, draw lines to connect the highest and lowest prices for your chosen time frame. The support line should reflect the lowest price points, while the resistance line should indicate the highest. This visual representation will help you clearly see the price range.

Incorporate Technical Indicators

If desired, add technical indicators like the RSI and Stochastic Oscillator to your chart for additional insights. These tools can help confirm your analysis and improve your decision-making. Experiment with different indicators to find what works best for your trading style.

Place Your Trades

After identifying your support and resistance levels, navigate to the Market Watch window to place a live trade. Choose your asset, specify the trade size and leverage, and confirm your order. Ensure you have a clear plan for entry and exit.

Monitor and Manage Your Trades

Keep an eye on your open trades to assess performance and make adjustments as needed. When you reach your desired profit level, log back into your trading platform to close your trade. Continuous monitoring helps you stay aware of market conditions.

Practice with a Demo Account

If you’re new to range trading, consider using a demo account to practice your skills risk-free. This will allow you to experiment with different strategies and familiarize yourself with the trading tools available on your platform. A demo account helps build confidence before trading with real money.

Experiment and Refine Your Strategy

As you gain experience, you may need to test various trading strategies to determine which best aligns with your trading goals. Continually refine your approach based on your findings and performance in the market. Keeping a trading journal can help you track your progress and learn from past trades.

Continuous Learning and Adaptation

The world of trading is constantly evolving, and it’s essential to stay informed about market trends, economic events, and technical advancements. Engaging in continuous learning will improve your skills and adapt your strategies to changing market conditions. Here are a few ways to stay informed:

- Follow Financial News: Stay updated with financial news through reputable sources, including economic data releases, central bank decisions, and geopolitical events that can impact market sentiment.

- Participate in Online Trading Communities: Join forums or social media groups where traders share insights, strategies, and experiences. Engaging with a community can provide valuable support and knowledge.

- Attend Webinars and Online Courses: Explore educational resources that cover range trading and other trading strategies. Many brokers and trading platforms offer free webinars and courses to enhance your skills.

- Read Trading Books: Invest in books that focus on trading psychology, risk management, and technical analysis. Expanding your knowledge will improve your decision-making and trading performance.

- Practice Regularly: The more you practice range trading and experiment with different strategies, the more comfortable you’ll become. Set aside time to trade and reflect on your performance regularly.

Range trading is a versatile and accessible strategy that can benefit traders in various market conditions. By understanding the fundamental principles, effectively analyzing support and resistance levels, and implementing proper risk management, traders can successfully capitalize on price movements within defined ranges. Whether you’re a novice trader or a seasoned professional, mastering range trading will enhance your trading toolkit and improve your chances of success in the financial markets. Remember to continuously learn and adapt your strategies to stay ahead in this ever-changing environment. Happy trading!